Families with children who are responsible for changing diapers may experience some alleviation due to a non-partisan tax bill being proposed in Kentucky.

A measure gaining support from both sides of the aisle in Kentucky proposes to provide tax breaks for exhausted parents who are constantly changing diapers, as this essential item can be a significant financial burden.

The legislation would exclude diapers from the state’s 6% sales tax. Senators from both political parties have joined as co-sponsors, and the idea was enthusiastically supported by the leader of a diaper bank in Kentucky. They believe it addresses a difficult situation for families in need, who often have to sacrifice food and other necessities to afford fresh diapers or resort to reusing disposable ones.

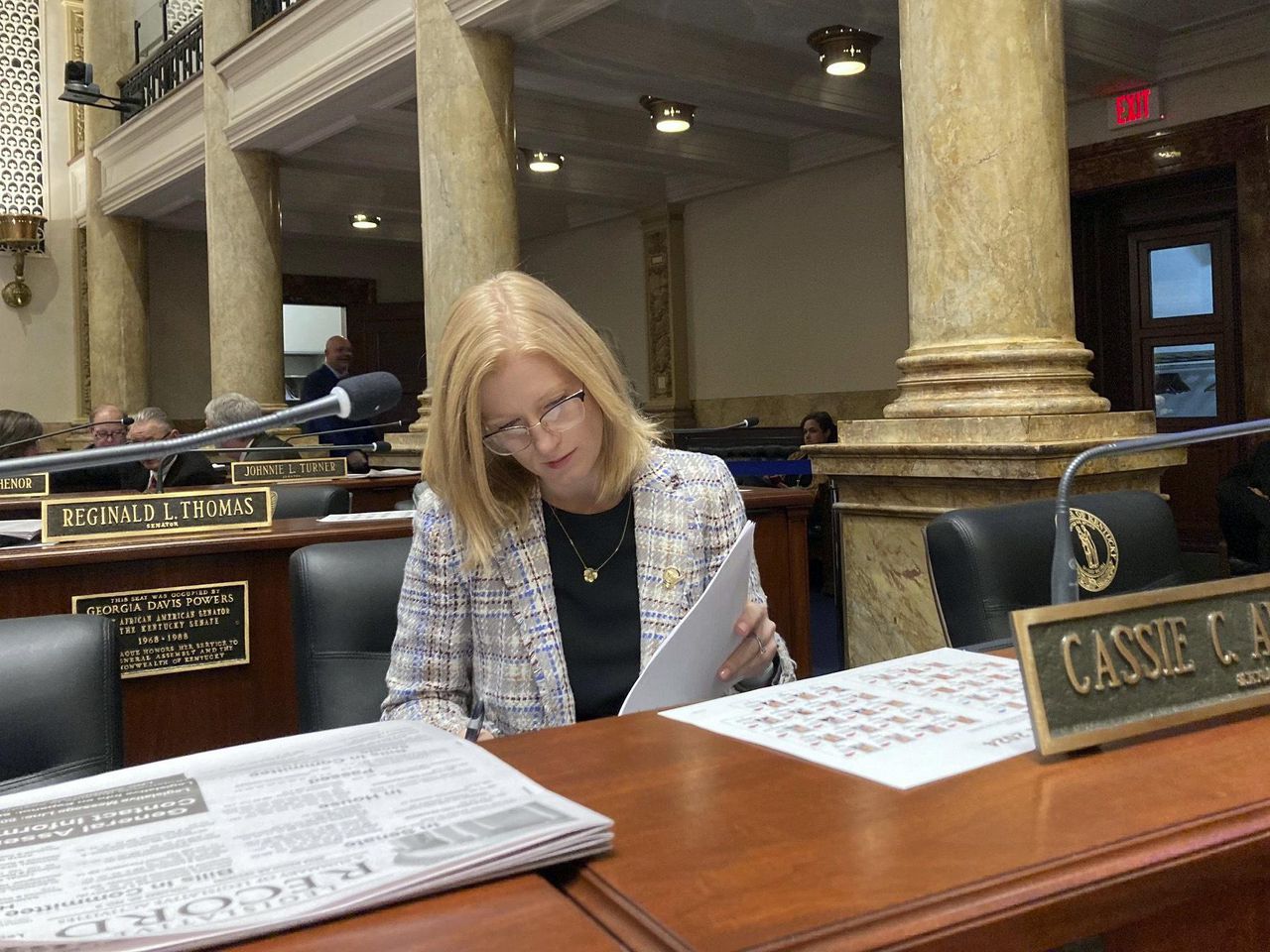

“In a recent interview on Friday, Democratic Senator Cassie Chambers Armstrong, the primary sponsor of the bill, stated that upon learning about the bill, it resonates with everyone. Those who have young children or grandchildren are aware of the financial burden that comes with purchasing diapers. It’s a significant expense for families, especially those with two children in diapers, costing several hundred dollars a month. The bill aims to provide relief for these families.”

Chambers Armstrong, a mother of two young children, understands the need to constantly buy diapers. She suggests that by eliminating Kentucky’s sales tax on diaper purchases, families with babies or toddlers could potentially save hundreds of dollars annually. This exemption would also extend to adult diapers.

Chambers Armstrong emphasized the importance of saving over time, stating that even a small percentage, such as 6%, can make a significant difference when every penny is accounted for.

The National Diaper Bank Network reports that the challenge of affording diapers is on the rise. When families are unable to consistently provide clean diapers, their infants are at a higher risk for uncomfortable rashes and urinary tract infections, leading to more frequent trips to the doctor. Additionally, if parents cannot afford to supply diapers for child care, they may have to miss work or school.

Last summer, the organization reported that 26 states were implementing sales tax on diapers. The tax rate for diapers can range from 4% to 7%. The organization also stated that children typically need around 50 diaper changes per week.

Deanna Hornback, the organizer of a diaper bank in Louisville, has been informed that some families are resorting to rinsing or patching up disposable diapers in order to continue using them. She believes this is a “quiet demand” that is growing and believes that implementing the tax exemption would greatly benefit struggling families.

In a telephone interview on Thursday, she stated that this bill will not only assist impoverished families, but also those who may be overlooked or have difficulty asking for help due to pride. Therefore, this bill will benefit everyone.

Chambers Armstrong, a Democratic member of the legislative chamber, has gained support from her Republican counterparts for her idea. Even Senate Majority Floor Leader Damon Thayer, a Republican, is backing the bill as a cosponsor.

“I believe this is an excellent bill,” Thayer expressed on Friday. “As Republicans, we advocate for tax reductions. Diapers are a necessary essential for daily living.”

Although the bill has received a lot of focus, the specific steps for implementing a sales tax exemption for buying diapers are still uncertain. According to Thayer, bills related to revenue must originate in the House, so Chambers Armstrong’s proposal may be added to a House bill.

Chambers Armstrong stated that any method used to accomplish the task is considered a victory.

Implementing the exception for buying diapers would result in a loss of approximately $10 million in revenue for the state of Kentucky annually. This amount is insignificant when compared to the current sales tax exemptions for food and medicine, and considering the state’s significant budget surplus due to increased tax collections.

Chambers Armstrong believes that her bill’s potential financial consequences are excessive, stating that residents of Kentucky will probably use the money saved from the diaper exemption for other essential items for their families.

She stated that regardless of the expense to the government, exempting diapers from taxes would alleviate financial strain for families.

“When you have young kids, one thing that constantly crosses your mind is the cost of diapers and how to afford them,” she explained. “I consider myself fortunate to have been able to purchase the diapers we needed, but the expenses of having two children were overwhelming. It makes me think about all the families who face similar struggles and how we can support them.”

___

The legislation is Senate Bill 97.